Michael Bloomberg started his company in 1981. He was already 39 years old. He faced large incumbents with tens of thousands of installed terminals and by global news agencies. Let's take a look at how he cracked the code to become the dominant player in financial information

After getting his MBA in 1966 he joined Salomon Brothers: "It was a pretty lowly start. We slaved in our underwear, in an unair-conditioned bank vault, with an occasional six-pack of beer to make it more bearable." "We counted billions of dollars of bond and stock certificates"

He put in the work work and eventually became head of the equities trading desk: "I used to get in at 7 a.m. I was the only one in the trading room other than Billy Salomon. Then I would stay till 7 at night, and after 6 the only other person in the room was John Gutfreund"

"90% of life is showing up. That really is true. All you gotta do is outwork the other person and you got a good shot."

He also developed a computer system to get bond quotes. When he made partner in 1972 he announced his promotion to his colleagues via their new terminals. But he didn't quite get along with everyone: "I kept telling John Gutfreund I could run the company better"

By 1979 he was demoted and put in charge of IT operations. Lucky for him, Salomon was acquired by Phibro in 1981 and as a partner he received a $10 million "Salomon Brothers did me the two greatest favors in my life. They hired me and they fired me" Time to retire? Not quite.

"You gotta get going. Nike has it right." On being fired: "Nobody likes to be told you're history. It's a rejection, it hurts your ego. But it didn't matter. I don't remember looking back. This is what it is. And I look back now: thank goodness they fired me."

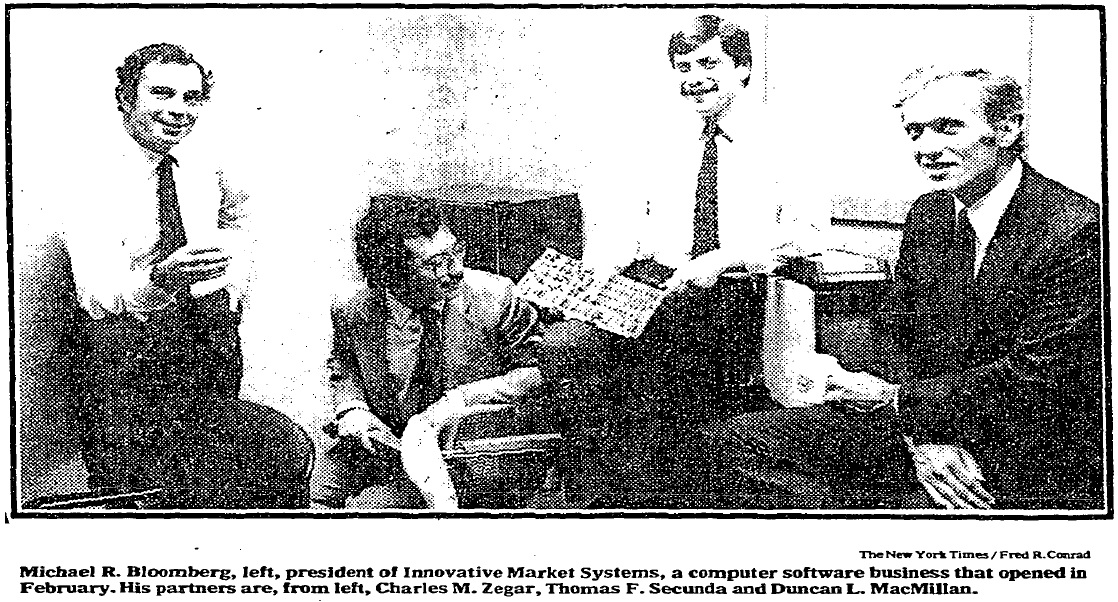

He launched his own financial information and technology company called Innovative Market Systems. His terminal was the "Market Master" It was 1982 and the US was in a recession. The New York Times stopped by to interview entrepreneurs bold enough to start a new business

"This is an interesting time. You can’t go out and start a steel mill, but the position of the business cycle and the rate of technological change are such that people can go and start small companies when they have a few people with good ideas.”

"The other question you have to ask is 'What businesses are failing?' I think businesses already in existence tend to have greater problems during a recession, as people stop spending or change their buying habits. I'm not sure that has anything to do with new businesses."

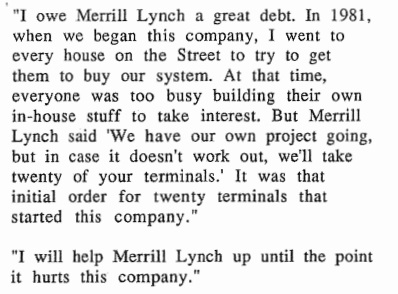

Bloomberg went out to pitch his idea. The only firm willing to commit to his new system was Merrill Lynch. They ordered 20 units. They also invested $30 million for a 30% stake. "I went to every house on the street. It was that initial order that started this company"

This is what the original terminal looked like. (h/t r/retrobattlestations) Fast forward to the 90's: the terminal now has a trackball and built-in voice

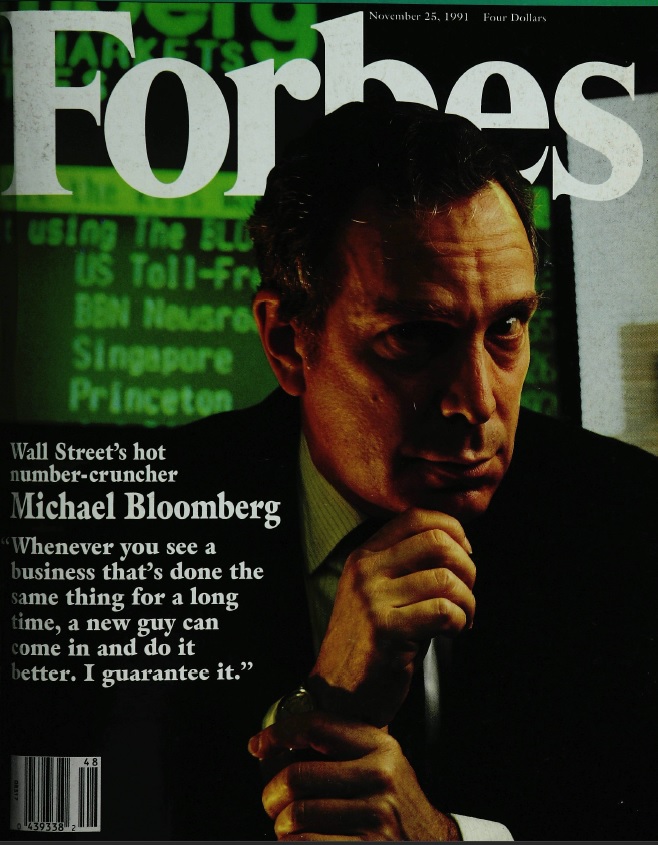

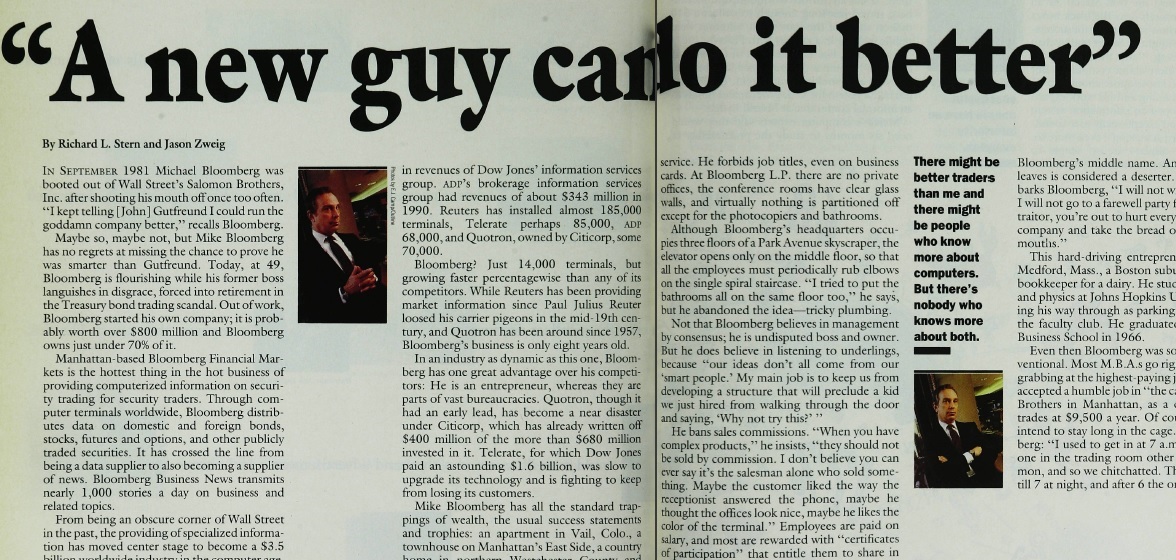

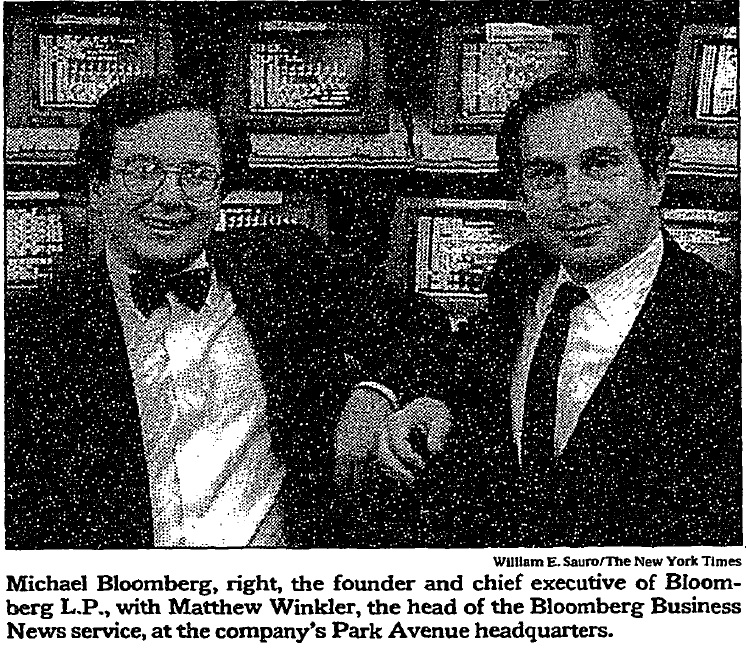

In 1991, Forbes did a big profile of the upstart that clearly had a lot of momentum By then, Bloomberg had 14,000 terminals. Compared to: Reuters: 185,000 Dow Jones Telerate: 85,000 Quotron (owned by Citi) 70,000 ADP: 68,000 Dwarfed by the incumbents but growing rapidly.

An excellent piece written by none other than @jasonzweigwsj

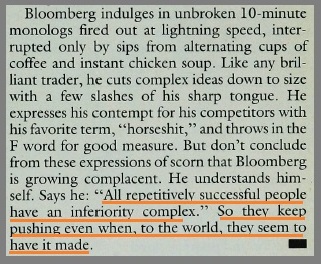

He was passionate about the business and very competitive, with something to prove after Salomon. "All repetitively successful people have an inferiority complex" "If you leave, I will not wish you the best. I will not go to a farewell party for you."

He also believed that going up against large, bureaucratic competitors gave him an advantage. "I was quoted saying 'Sunday night was my favorite night of the week because I was going into to work.' I said I didn't say that, but there's a reporter who has it on tape."

"If we had come into an industry with small, scrappy companies it would have been much harder. Big companies come with an enormous management staff that resists change. Like generals who never actually want to go to war because they've got big cushy jobs getting ready for war."

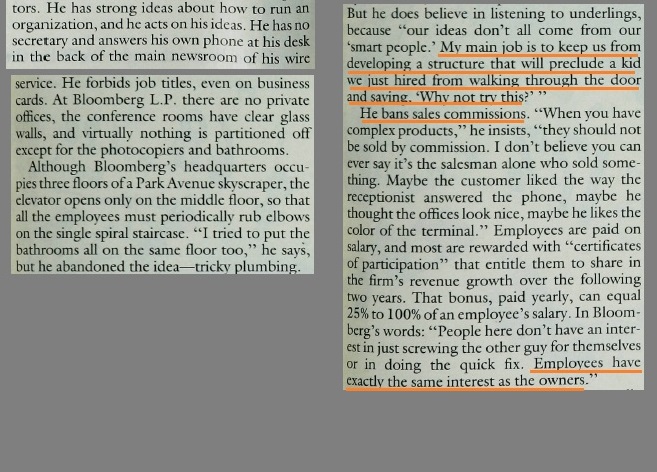

He built a different culture: no titles, no private offices, no sales commissions, bonuses based on company growth "My main job is to keep us from developing a structure that will preclude a kid we just hired from walking through the door and saying 'Why not try this'"

From the 1990 "Portable Bloomberg" booklet: "I wondered if I had joined a religious sect, such was the dedication of the employees to its founder, and their enthusiasm for the company."

Being nimble and focused, he could use speed to his advantage. Remember the Merrill deal? They wanted six months to think about the system. "I'll deliver a finished product in six months. If you don't like it, you don't have to pay for it"

"Instead of doing what our competitors do, which is to take 2-3 years to perfect a technology that is then a fossil, we just throw it out there and work with our customers to perfect it."

Around this time he also started Bloomberg Business News: "Our mission is to provide everything that issuers of securities, investors and intermediaries need around the globe. That includes news."

"Successful media companies have to have two things. They have to control their own distribution and they have to have their own programming. People that don't have both either have to rectify that or go out of business."

Decision-making: "I just do it. I go by my gut" Translated by Fortune: "He lives by a single principle: do something only if it improves the core business, namely moving those terminals, which accounts for practically all the revenues. Anything else is a waste of time"

But what really him so successful? He had a unique understanding of the product and customer: "There might be better traders than me and there might be people who know more about computers. But there's nobody who knows more about both."

His competitors were news and newspaper companies: "They don't believe in adding value, in analyzing data." "Whenever you see a business that's done the same thing for a long time, a new guy can come in and do it better. I guarantee it."

"When I came to Wall Street, the sell-side controlled the information" "If the buyside could get information, they would be able to even to fight. And there would be demand for my product. And we leveled the playing field."

He constantly increased the terminal's value by adding more data and functionality

"The only way for them to get more revenue is to charge extra for each new service" "We have an incentive to add more capability because we will get incremental revenue from placing more terminals"

Because of his background, he understood the value of going one step further: don't just offer information, offer analysis which leads to insight. The bond valuation function was one example.

"They key was that we collected information that people needed. We gave you a way to find it. And then we gave you some computer programs so you could do something with it - without you learning how to program, without you learning how to be a mathematician."

Eventually, customers would want only one terminal. The one that offered everything: all the data and the analytics to make your job easier and get things done faster. At that point, pricing power would likely appear.