Ok, since a lot of people seem confused, I'll explain what's going on with GME. Brace yourselves. This is gonna be a long thread.

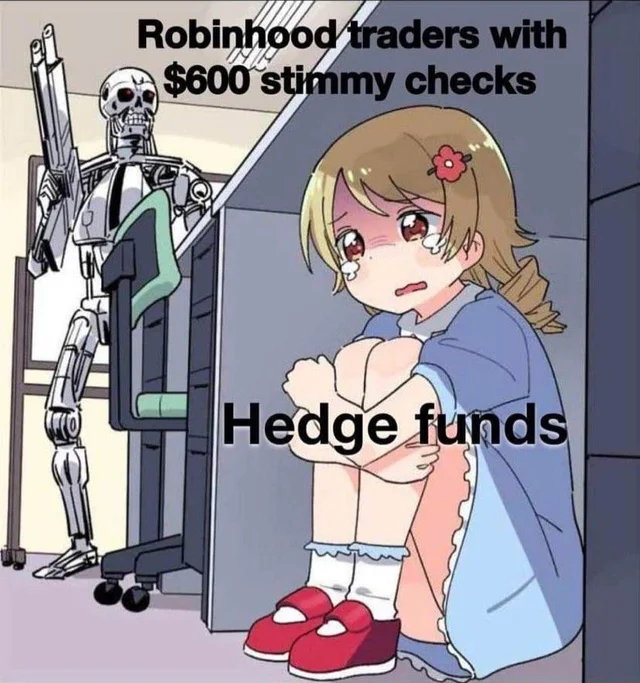

This is a once in a lifetime historical event. It's insane. At least 1 hedgefund has gone bankrupt, thanks to a group of average joes on Reddit. By the end of the week, there will be a line of bankruptcies. So let's start at the beginning:

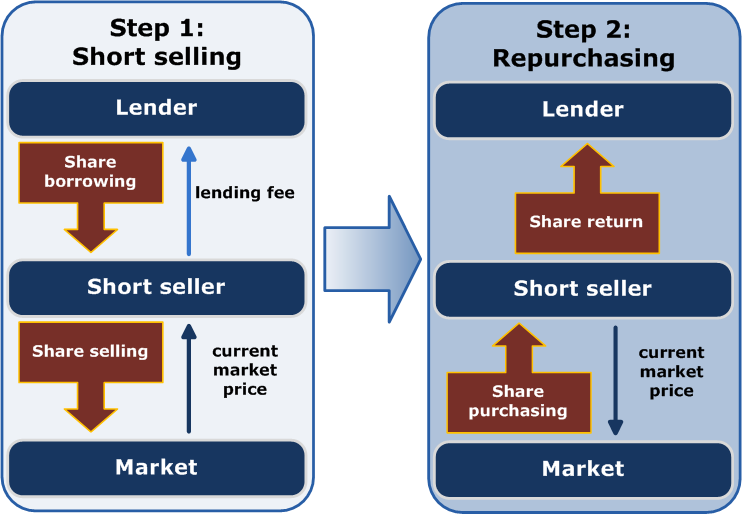

Stocks are pretty simple, when they go up in value, you make money, because it's worth more than you bought it for. Stock goes up- you make money. Stock goes down- you lose money. Short selling, is the opposite. Short selling makes money when the stock goes down in value.

So for example: Tim borrows Bob's shares in GME, and sell them for $10, he pays Bob $1 to do this, and promises to give all of Bob's shares back. Then, if the stock goes down to $5, Tim buys the shares back at a cheaper price. So Tim's profit is $10-$5-$1 = $4 profit.

So that's where we start. A hedge fund tried to force down the price of Gamestop, and short the stock. It usually works fine. It's been done thousands of times, with no problems.

So they shorted Gamestop (GME) from $20, to $10, to $4. Their greed kept compounding. They kept doing it again, and again, for months. Making billions of dollars, and almost bankrupting this company. (shares and share price are used as collateral for loans and access to capital).

So they shorted Gamestop (GME) from $20, to $10, to $4. Their greed kept compounding. They kept doing it again, and again, for months. Making billions of dollars, and almost bankrupting this company.

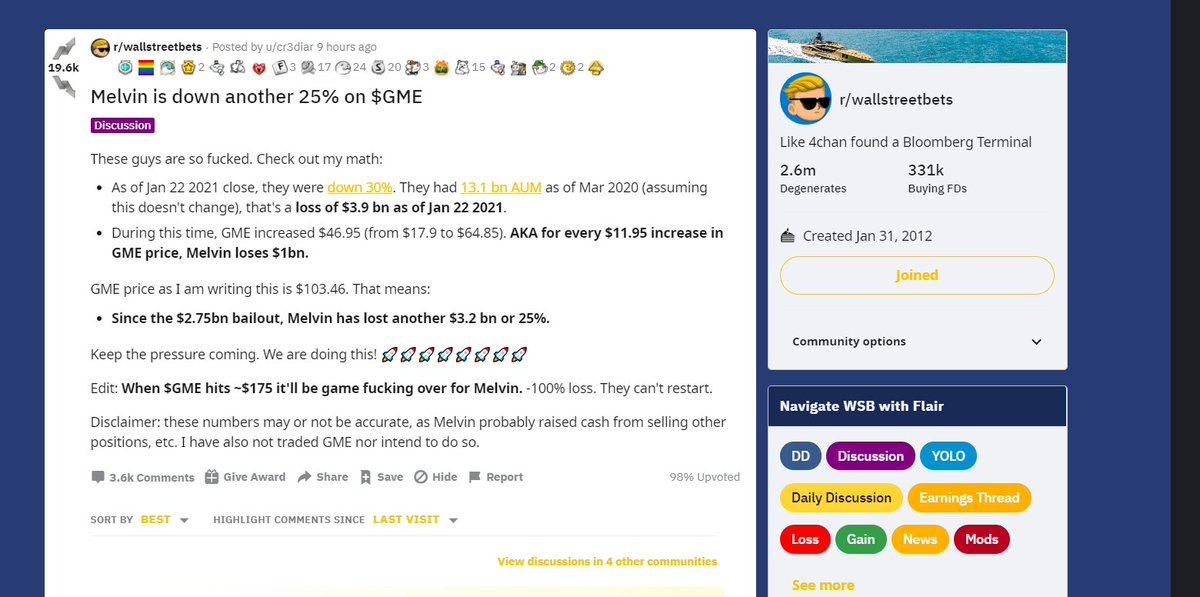

Enter Wallstreetbets- A trading/investing subreddit. Someone noted that these hedgefunds shorted 140% of all shares available. These hedgefunds were so damn greedy, they borrowed more shares than actually existed. That's how arrogant and dumb they were.

They borrowed 140% of all the available shares. It was literally impossible for them to buy them all back. So someone on Wallstreetbets realized this, and told everyone. Now, the rule with short selling is that ALL those shares that they borrow, MUST be paid back.

And so we reach our main story of how the hedgefund's greed ruined them. Realizing that these hedgefunds shorted GME by a ridiculous amount, these Redditors (normal people like you and me), bought every share they could get their hands on. Driving the price up like crazy.

Why? Because these hedgefunds eventually (within a few months) HAD to buy all those shares back, at whatever price they could get them. They didnt have a choice.

So for example, if they borrow 10 million shares, and sold them for $10. They made $100 million in immediate profit. But eventually, they HAD TO buy those million shares back. They didn't have a choice. That was the deal they made when they borrowed the shares.

So these Redditors bought the shares, driving the price up, forcing these hedgefunds to buy back at crazy prices. Yeah, the hedgefund sold and made $100 million, but now they had to spend $1.4798 BILLION getting those same shares back. A HUGE FUCKING LOSS of $1.3798 BILLION.

So eventually, the due date for when these hedgefunds need to return the borrowed shares comes closer. And what do they do? They double down. They short MORE. Because they're sure that they can manipulate the stock enough to get it to crash, thereby saving themselves.

Fast-forward a few days, every attempt to crash the stock fails. Everyone knows what theyre trying to do, so people keep buying the stock. And with every additional bit of media attention, more and more people are buying the stock, destroying the greedy hedgefund in the process

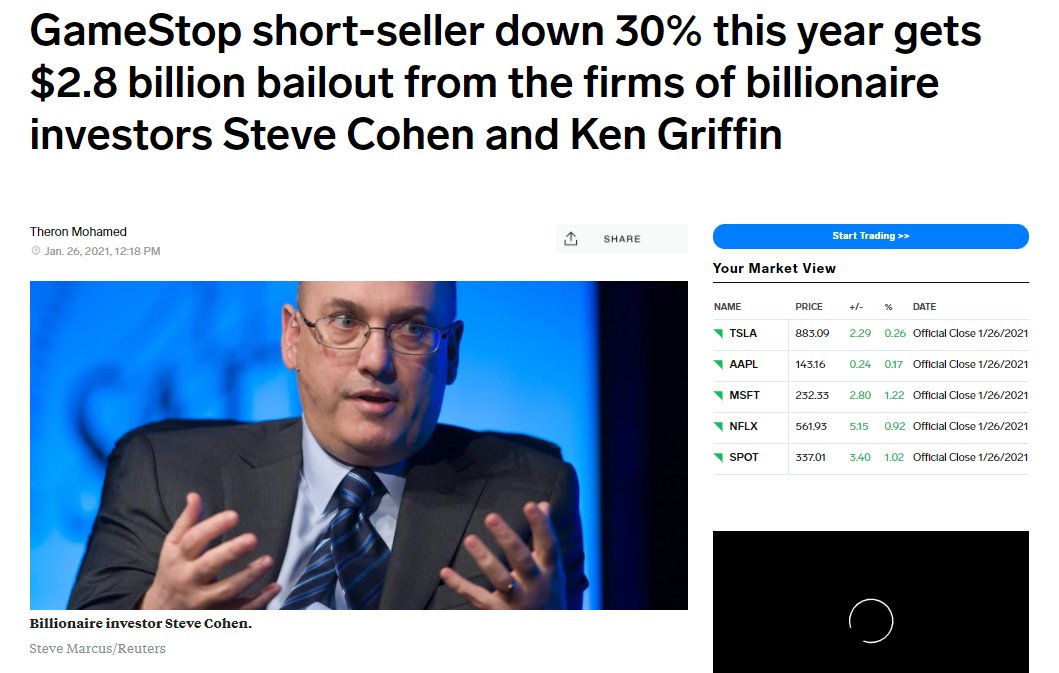

Eventually Melvin Capital- a multi billion dollar hedge fund, needs a bailout, because it has lost so much money shorting GME. They borrowed billions off another hedgefund. That was Monday. The stock price was $76.

Yesterday the stock ended up at $147.98 for every share. Up from $4. These hedgefunds are STILL shorting the stock, at 130% of available shares. That's how fucking greedy these guys are. All those millions of shares STILL have to be paid back.

So now Hedgefunds are crying on literally every platform they can get their hands on. They want the government to stop trading. They want this reddit forum investigated and banned. They're screaming ''market manipulation'', when in reality these hedgefunds.....

were the ones manipulating the stock, but they got caught, and are now trying to take their ball and go home. While these hedgefunds are on every news channel screaming about Reddit and Wallstreetbets, they inevitably draw attention to themselves, and what's going on.

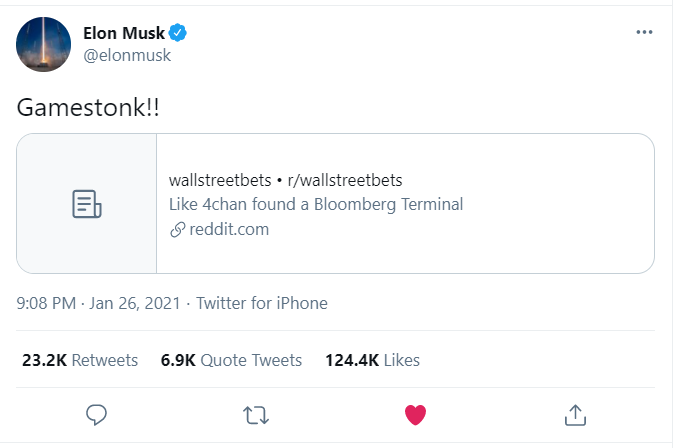

Enter the ''whales''- individual investors who can make a splash and impact the stock. Millionaires and billionaires that have a bone to pick with hedgefunds and short sellers. (whether you like these people or not is irrelevant, they're part of this story regardless)

Elon Musk hates short sellers, because they tried to cripple Tesla so often. With a single tweet, Elon sent the share price skyrocketing from $147.98 to $230. And along with Elon Musk, a huge number of wealthy ''whales'' have started to jump in. Buying up HUGE amounts of stock.

But these investors don't care. They don't care how expensive they buy the stock for. Because they KNOW these hedgefunds MUST buy the shares back. For many of them, they don't actually care if they lose money. They just want to watch these hedgefunds burn.

So what happens next? No one actually knows. As time goes on, and as hedgefunds fight to buy back as many shares as possible (driving up the prices more on each other), their bill will eventually be due, and they will have to return the borrowed shares.

Some hedgefunds may go bankrupt. But it's not guaranteed. Does this mean you should buy GME? I'm not gonna answer this question, because you obviously shouldnt be listening to strangers on the internet when it comes to your money.

There's a lot of upside to buying GME, but there's also a crazy amount of downside. Tomorrow the share could go back to $4 and you could lose everything. These shares are obscenely overvalued, and the only reason they keep going up is......

that people are gambling that the hedgefunds will buy them for a higher price (they likely will, but up until what point?). It's a game of chicken. When the game ends, the house of cards will crumble, and people will lose millions. But until then, fuck the hedgefunds.

#GME #GameStop #FuckTheHedgeFunds

Here's a follow up thread, discussing possible impacts of this Reddit vs Hedgefunds fight. But at this point, it's all just guesswork.

@MrBrownEyes2020 Out of all of this, there's only one question I have left. Does this incident prove that the stock market is inherently unhealthy and must close? Or just that hedgefunds is a practice that should stop?

@YeahSureWynaut It proves that the stock market is ridiculously unregulated. A stock market is a good thing. It's important for the economy. Businesses use it to raise money to build things, and expand. An unregulated stock market is basically evil. The rich get richer, the poor get poorer.

Update on this insanity:

We just watched history. Reddit was about to win against the hedge funds. So they changed the rules of the game. Brokers banned all buying of GME, but allowed all selling. Textbook market manipulation to drive the price down and save these hedgefunds.

As I write this, the price has crash from $400, to $125 in 10 minutes. Now millions of ordinary people have lost out all their money. This was literally a crime, performed in broad daylight. Because they know no one is gonna touch them. Man, Im fucking disgusted.

@AOC @RepKatiePorter @SenSanders @LeaderMcConnell @tedcruz Is this how the free market is supposed to operate?