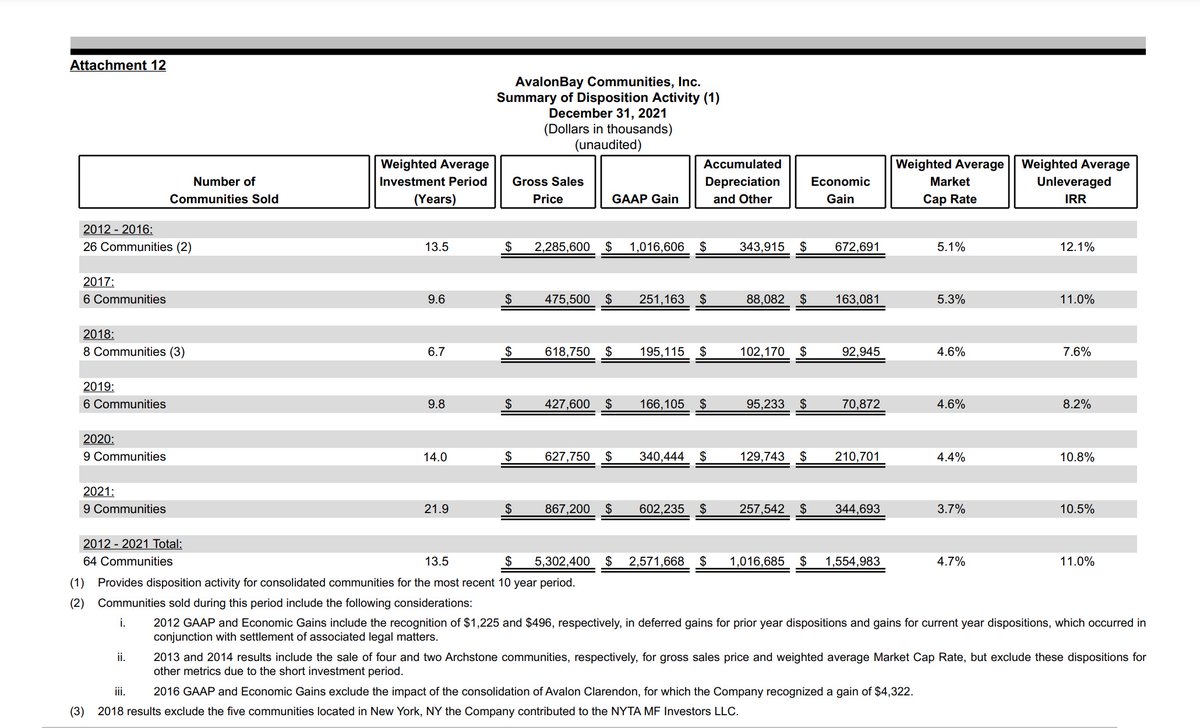

1/n Here's a snapshot of $AVB's dispositions over the past decade: $EQR $MAA $CPT $UDR $ESS #REITs

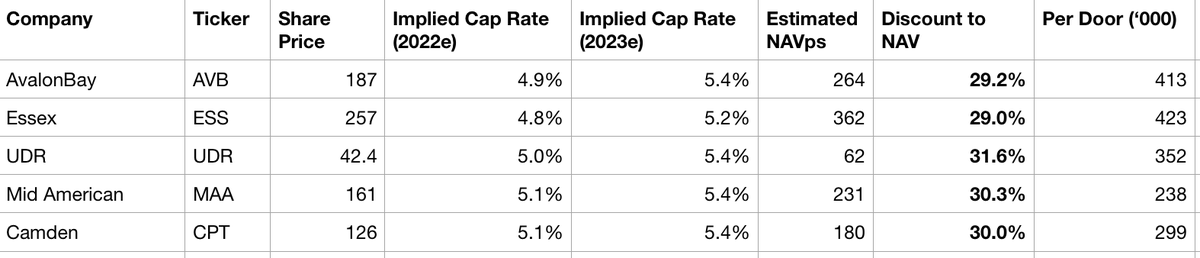

2/n Here's where we sit today. Given the huge leasing spreads on leases signed YTD, it makes sense to look at the 2023 #s which get the flow through of today's higher rent levels (doesn't bake in much future rent growth, say 3% for 2023)

3/n $BX started $BREIT in 2016 and we see a decline in caps from low 5 to high 3s. Bear in mind $AVB is typically selling from the bottom quartile/quintile of their portfolio - older assets/ not the best locations/ things they believe have the lowest hold period IRRs

4/n Here is #REPE dry powder going back 15 years

5/n Here is home price affordability going back 15 years from the Atlanta Fed

6/n Here is some commentary on construction inflation over time (it has almost always run ahead of overall CPI and has escalated):

edzarenski.com/2022/02/11/con…