🧵 25 Things I wish I knew about investing 20 years ago. Lesson 1: Invest for the long term. In the short run, stock returns can be very volatile, but they are very robust in the long run. Over time, stocks always perform better than bonds.

Lesson 2: On average, you double your money in the stock market every 10 years. The real return on equities (after inflation) has averaged 6.8% per year over the past 204 years.

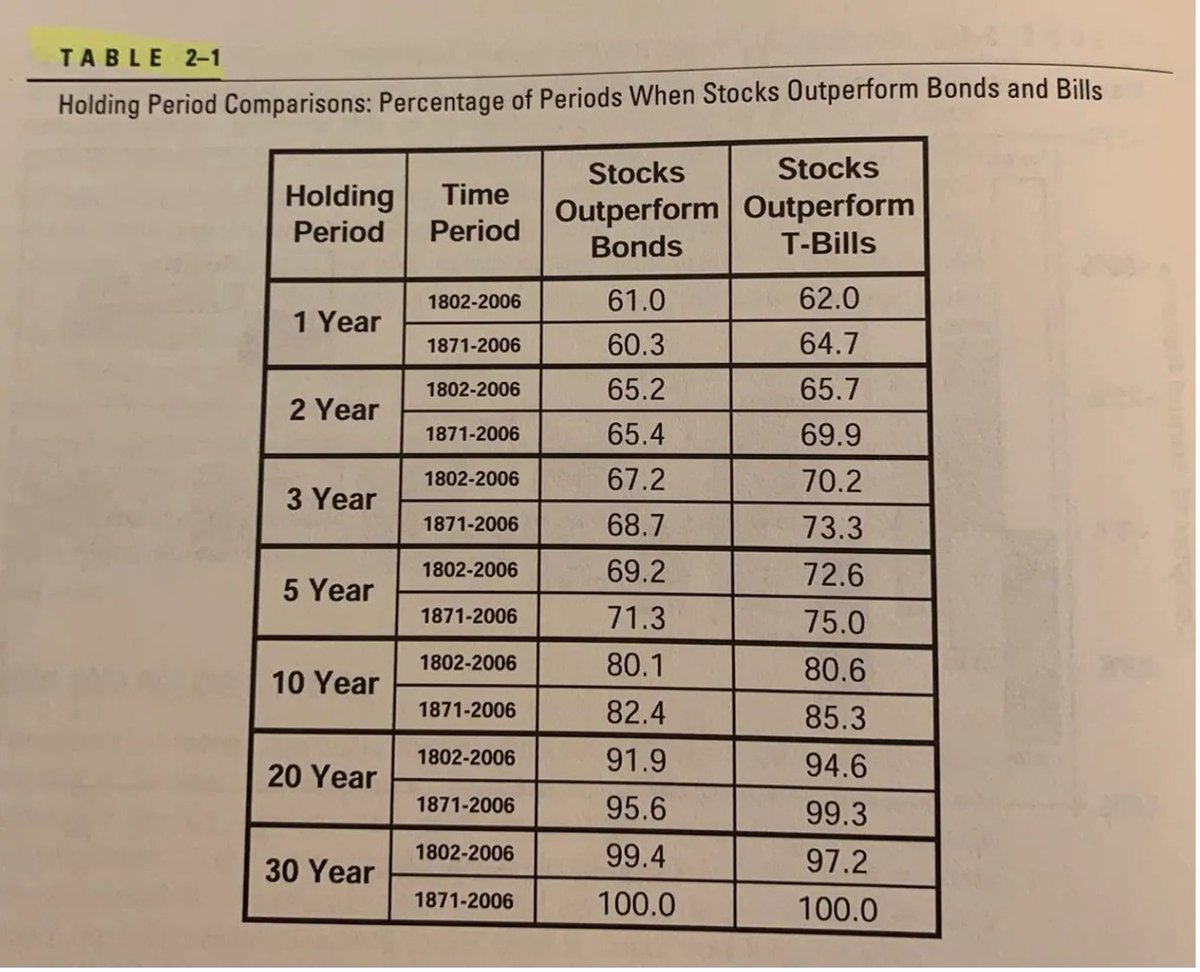

Lesson 3: In the long run, stocks are less risky than bonds. When you invest for at least 10 years, stocks have, on average, more than 80% chance to outperform bonds.

Lesson 4: Don’t try to time the market. As difficult it is to sell when stock prices are high and everyone is optimistic, it is even more difficult to buy at market bottoms when pessimism is widespread and few have the confidence to venture back into stocks.

Lesson 5: Our world continuously changes. As a quality investor, disruption is one of your worst enemies. Avoid companies who are highly exposed to rapidly changing industry dynamics.

Lesson 6: This time it’s not different. “Most of the change we think we see in life is due to truths being in and out of favor.” – Robert Frost (1914)

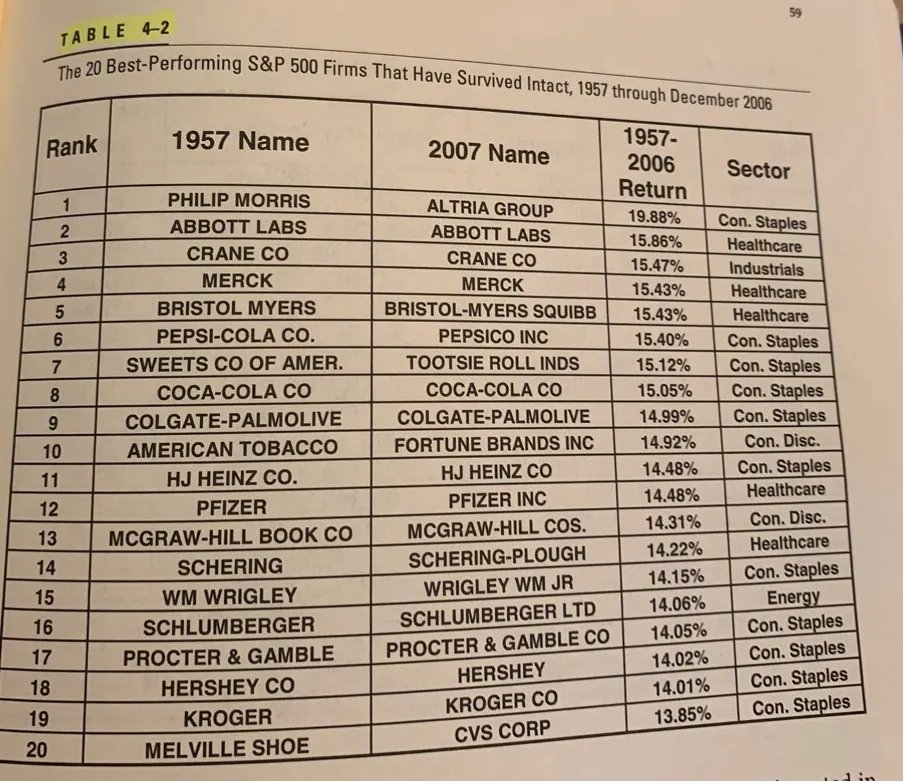

Lesson 7: Let your winners run. As an investor, you should let your winners run. Philip Morris is a great example. When you invested in Philip Morris in 1925, your investment would have multipled by a factor of more than 400.000 (!) today.

Lesson 8: Low stock prices are great for investors. If investors become overly pessimistic about the prospects of a stock, the low price enables stockholders to buy the company on the cheap. Bear markets and corrections are great opportunities for long term investors.

Lesson 9: Invest in companies that translate most earnings into free cash flow. Earnings are an opinion, cash is a fact. Academical research found that companies that translate most earnings into free cash flow outperform companies who don't with more than 17% (!) per year.

Lesson 10: The fundamental determinant of stock values remains the earnings of a corporation. The return of you as an investor is equal to the earnings growth plus shareholder yield (dividends and buyback yield) +/- multiple expansion / contraction.

Lesson 11: Look at the equity premium. Over the past 200 years, the equity premium (the spread between the return of stocks and return of government bonds) has averaged between 3% and 3.5%.

Lesson 12: In general, small cap stocks outperform. Smaller stocks generate a higher return on the stock market. Between 1926 and 2006, the smallest decile stocks compounded at a CAGR of 14.0% compared to 10.3% for the S&P500.

Lesson 13: Cheaper stocks outperform the market. Based on the price-earnings ratio, the 20% cheapest stocks outperformed the S&P500 by 3.2% per year between 1957 and 2006.

Lesson 14: Do not invest in IPOs. From 1968 through 2000, a buy-and-hold strategy on IPOs underperformed the index in 29 out of 33 years. “IPO: It’s Probably Overpriced.”

Lesson 15: Investors can outperform by using factors. There are many strategies that can be used to outperform the market (low volatility, value, quality, …). It is important to note that you should stick to your plan as no strategy outperforms all the time.

Lesson 16: In the long run, stocks are a great hedge against inflation. However, they are not in the short term.

Lesson 17: The stock market is a leading indicator for the economy. On average, the lead time between what happens on the stock market and what happens in our economy is equal to 6 months.

Lesson 18: Don’t use macro-economic factors to make investment decisions. “Using macro-economic factors will lead to buy at high prices when times are good, and sell at the low when the recessions near its trough and pessimism prevails.” – Jeremy Siegel

Lesson 19: The short term is highly uncertain. Less than 25% of all major market movements can be linked to a news event of major political or economic importance. This confirms the unpredictability of the market and the difficulty in forecasting moves in the short term.

Lesson 20: On average, the stock market fluctuates with more than 1% one day per week. “The percentage of trading days when the Dow Industrials changed by more than 1% has averaged 23% between 1834 and 2006, or about once per week. “ – Jeremy Siegel

Lesson 21: Over the past 2 decades, September has been the worst month on the stock market by far. “September is by far the worst month of the year. September is followed closely by October, which has a disproportionate percentage of crashes. “ – Jeremy Siegel

Lesson 22: Investing between Christmas and New Year is usually a great idea. Over the past 120 years, daily price returns between Christmas and New Year were 10 times as high as during normal periods.

Lesson 23: If you want to invest periodically, the best moment to do this is in the middle of the month. The reason for this is that at the beginning and end of each month, institutional investors are receiving inflows which they invest, resulting in higher stock prices.

Lesson 24: Establish firm rules to keep your portfolio on track. Lesson 25: Be fearful when others are greedy and greedy when others are fearful. In the table below you can see that the lower the investor sentiment, the better moment to invest in general.

The end. If you liked this thread and want to receive more content like this, please take a look at our Substack:

qualitycompounding.substack.com