The world has changed on energy bills so policy will have to too. We can wake up to that reality now or later, but either way we’ll be in a very different phase of this crisis policy wise by Christmas. A thread.

When we thought bills we're heading to mid-£2000s, the textbook economic answer of let prices rise (so everyone has incentives to cut use) + support lower income households was also the right answer. But it’s time to recognise that is not the world we’re living in

Tmrw will confirm October price cap will rise to £3,600. You can add another £1,000 to that in January. Rising prices will combine with falling temperatures (half of domestic gas use is between Jan & March). We’re on course for a winter catastrophe

Think about it this way, the typical energy bill in January could be £600. Those on direct debits can spread that, but 4m households on prepayment meters (30% of the poorest fifth) have to find the cash. I hope people realise they can’t (it’s half their disposable income)

Radically rethought policy answers are needed otherwise we’re heading for thousands having their energy shut off & millions running up arrears. Govt has already announced lots of support (£30bn+) but winter bills are now set to be 47% (£881) higher than we thought back in May

The current proposals from leadership candidates/opposition candidates won’t wash

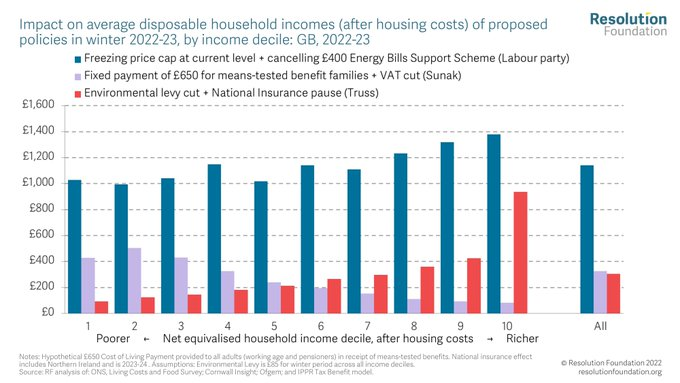

Scrapping VAT on bills (Sunak) or shifting green levies off billpayers and onto taxpayers (Truss) are fine, but tiny relative to the problem (£124 or £85 average savings this winter respectively)

Big tax cuts are totally irrelevant. Scrapping the National Insurance rise will see twice the benefit going to the top 5% as the entire bottom half. And while energy bills are rising across the country the tax cut will benefit Londoners twice as much as those in the North East

Opposition parties want to freeze all bills at current levels. Cost = £36bn this winter + £64bn next year. It gets at the core problem but is expensive because of no targeting: the richest fifth gain more from this policy in 6 months than from scrapping the NI rise over a year

Rishi Sunak proposes repeating targeted payments for those on means-tested benefits. This is highly progressive but the more we rely exclusively on it the bigger it's limitations becomes. The key ones are...

1) A massive cliff edge that sees those who arent on benefits get nothing (including 4 in 10 of the poorest fifth). As the problem/those payments get bigger the less tenable this is.

2) Those payments are flat rate so take no account of very different energy bills (and therefore energy bill rises).

Can we do better? Yes. Time to recognise that the idea poorer households need to face the full marginal cost of energy for "incentives" reasons is dangerous at this point. To be blunt we are going to be capping energy costs, the question is 1) for whom 2) how we do and pay for it

There's two broad options for the way forward: 1) a much more radical social tariff that cuts bills for lower income households, but not just those on benefits 2) universal bill reductions (which should be accompanied by windfall/solidarity taxes)

A radical social tariff offers a more targeted solution: 30% bill reduction for households on benefits OR where no-one earns more than £25,000 (& a 12% cut where no-one earns over £40,000+) would help 94% of the poorest half (vs 45% if limited to those on benefits). Cost = £15bn

Advantage of this approach is that it directly targets both energy usage AND income. The challenge? Implementation is hard (but not impossible). Those on benefits could be automatically enrolled, while others would apply to their energy company with govt checks via tax data

The administratively easier (but politically more difficult) route to achieve broadly the same outcome is to cut everyone's bills and then claw back the gains from higher income households via taxes

Here's an example: a 30% bill cut for everyone + a 1% increase in all income tax rates would see the large costs of £23.5bn offset by a £9.5bn tax increase with 60% paid by the top fifth

Advantages: not just borrowing avoids wasting resources/making @bankofengland's job harder, administratively easy Disadvantages: reduces the incentive of higher income households to cut consumption, will be some that lose out overall

One reason we need to urgently get on with thinking these things through is that there are big trade-offs/decisions to be made that are currently being ignored

The big picture fiscal side of this needs more attention - we're talking about the third big ratcheting up of debt in 15 years, but this is the first happening while the costs of that debt are also being increased

We shouldn't be totally relaxed about that: rising gas prices AND the likelihood that governments are about to put in place big fiscal support are partly why markets are expecting bigger interest rate rises

It doesnt matter whether you came into politics to raise/lower taxes, this is a time for ramping up windfall taxes (yes including on renewable generators making huge windfalls). But don't pretend windfall taxes can cover this: too many of those windfalls happen outside the UK...

...which is why solidarity taxes (ie on those able to contribute more) normally come into play in situations like these. Churchill wasnt a communist but taxes on the top rose in WW2 a lot

The country has become poorer, we're going to use fiscal policy in a big way to prevent that causing destitution and need to face up to the choices about how that is paid for: answer is a mix of those making windfalls, those able to pay more now and taxpayers tomorrow (borrowing)

The fiscal issue isnt that we can't afford to cover everyone's bills this winter - it's that we don't know how long this will go on for. So ideally we'd put in place an approach that isn't so expensive (either via targeting or recouping it via tax) that we can't sustain it

Note France basically started at the "state picks up the rising energy costs for everyone" end of the market and is now heading the other way (ie allowing bills to rise) because of exactly this problem.

Some argue our proposals to cap energy costs are wrong because it's dangerous to tamper with a free market. They just don't seem to have noticed that there's not much free about a market Putin is controlling

Others will say it's essential consumers have the maximum incentive to cut consumption. This is important but lacks perspective, especially for poorer households. Once prices are up 200% do we really think an increase to 250% massively changes incentives much?

Remember some basics: 62% of poorest households are renters, jacking up their energy bills doesnt incentivise landlord to sort out insulation. In many cases we absolutely do not want to further incentivise reduced energy use: cold homes lay behind 8,500 excess deaths in 2019

It goes without saying that we must at last also get serious about the longer term answers to this nightmare: - accelerate renewable/nuclear generation capacity - reform our market to delink electricity from gas prices - make energy efficiency a policy priority

That War and Peace length thread is probably enough so I'll leave it there. Please do read our new report out today, with great work from @FryEmily @JMarshall_3 @MikeBrewerEcon @karlhandscomb