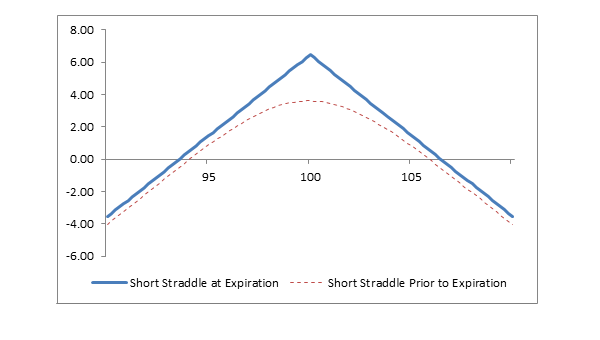

HOW TO ADJUST A SHORT STRADDLE? A thread🧵 Short straddle is the most basic strategy but many people are unaware about various types of adjustments that can be used to adjust a straddle when it goes wrong and come out with profits.

1: Make One side Risk free. When you initiate a short straddle and the market starts to go in one direction you can easily make it risk free by simply buying Slightly Otm option of the tested side.

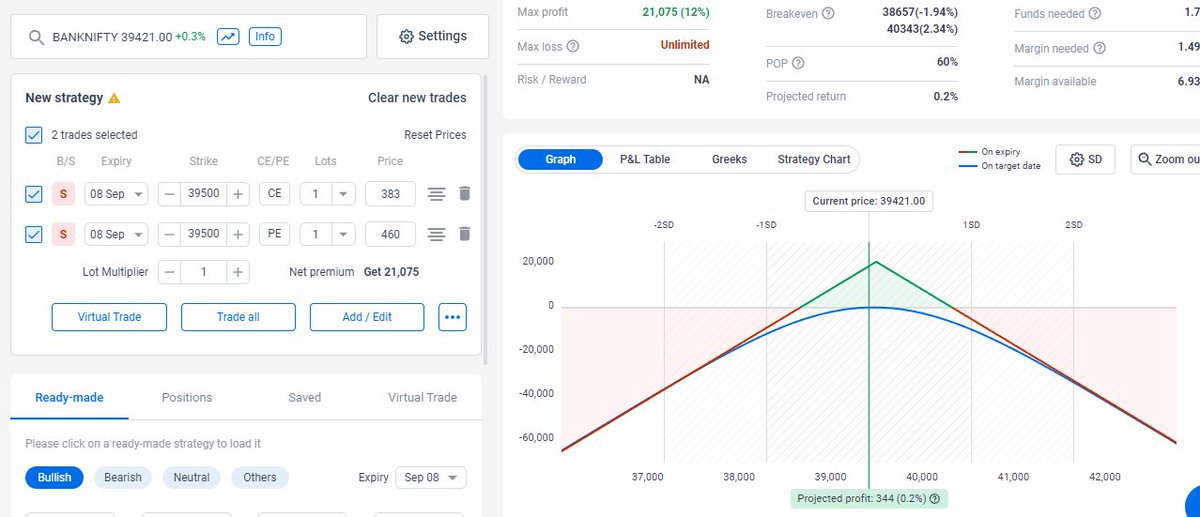

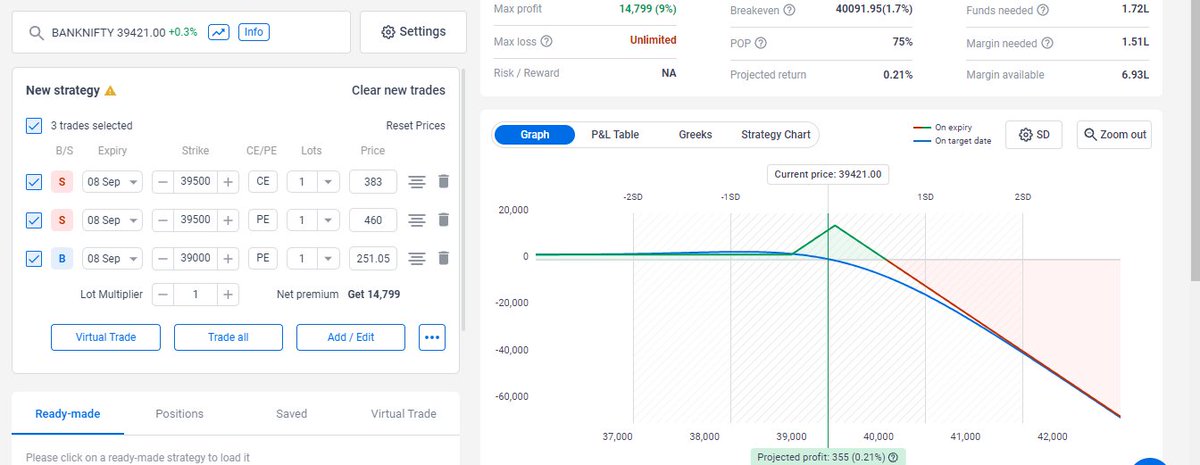

eg: Lets say you initiate a 39500 Short straddle in weekly options. And you want to secure the put side.

So you can simply buy 39000 pe same qty and your straddle is risk free on the downside.

2: Shifting the short straddles. If the market moves significantly after you created a new short straddle, you can simply keep on shifting your short straddle. This is the most basic type of adjustment.

eg : If you sold 39500 Banknifty Short straddle. Banknifty goes to 39800. Then you can simply exit 39500 SS and shift to 39800. Basically you are staying with the market all the time which increases your probability of winning.

3: Creating a new Straddle. If you've sold a short straddle with only a part of your capital then you can always make a new short straddle when the market moves. It greatly increases your range. Eg: If you created a 39500 Short straddle

And Banknifty goes to 39000. Then you can add a 39000 Short straddle without exiting your previous straddle. This ensures you get a very vast range.

3: Converting it into a strangle. If the market starts to move in one direction after executing a short straddle, you can always roll the untested side.

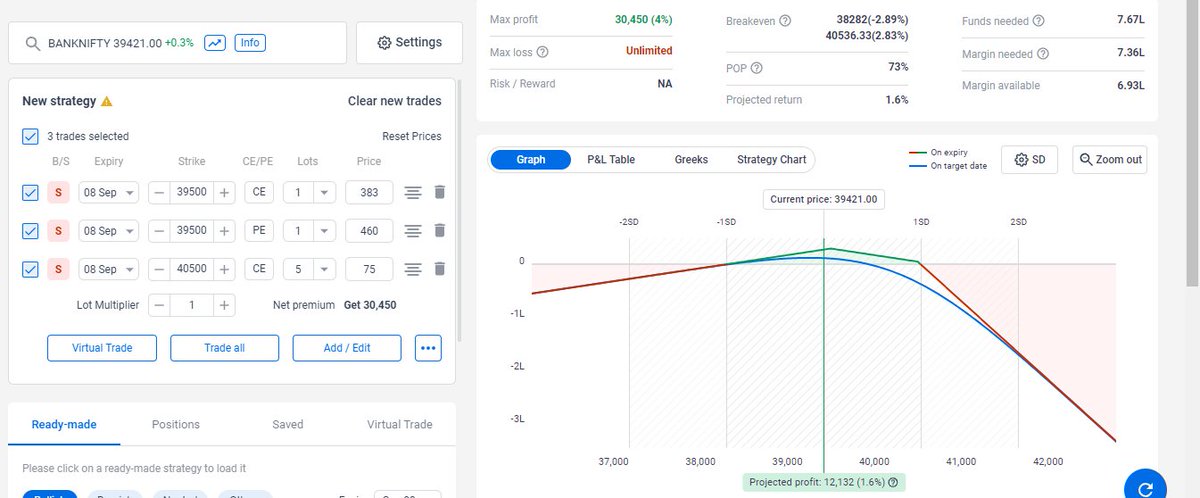

Eg: If you executed a 39500 Short straddle and Banknifty starts to go up. In that case you can exit 39500ce and sell 40000ce which converts straddle into a strangle and increases your safety and range at the same time.

4: Reference trades. To maximize your profits you can always sell otm options of the untested side. It's a risky strategy so it has to be done with caution.

Eg: After you initiate an atm short straddle at 39500. Banknifty starts to slightly go down. You can always sell far otm calls to squeeze out some profits. Qty can be adjusted as per your comfort and risk appetite.

5: When to book a loss. If at any point the total loss reaches more than 2% of your entire capital then simply book a loss, step back and re analyze.

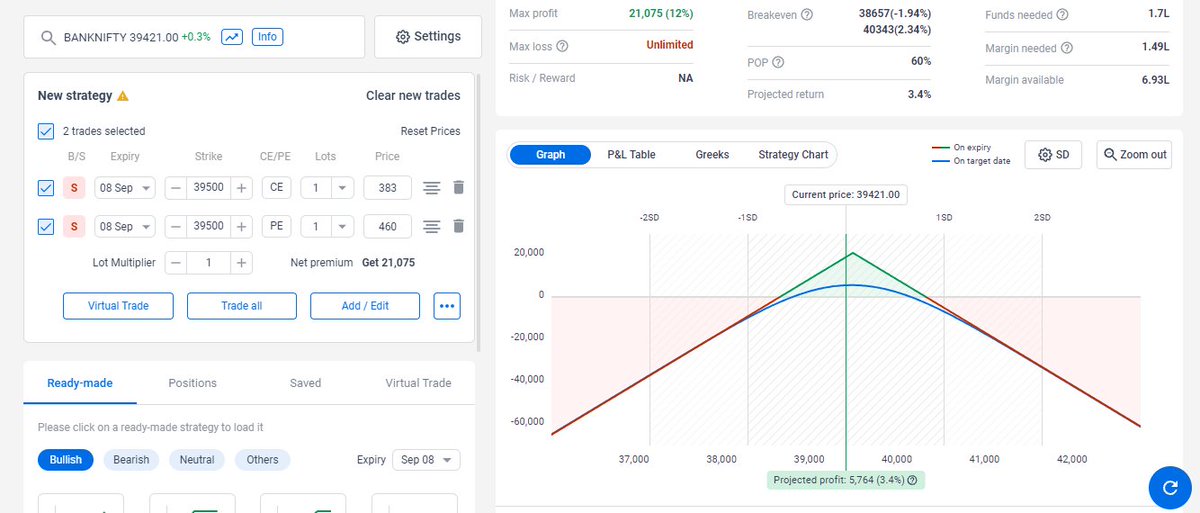

6: Convert it into an Ironfly: If one isn't comfortable with the unlimited risk as it's naked, one can always convert it into ironfly by buying both side Slightly otm options and make it risk defined.

7: When to book Profits: Ideally you don't want to book profits at any random point. Rather keep on trailing your stoploss and exit when it hits. Because you want to extract the maximum profit when it is actually giving you money.

That's it for this thread. For more learnings you can join our "Inner Circle". https://t.co/FvOyVhXTWt

rigipay.com/g/dQVOq6njkI?n…